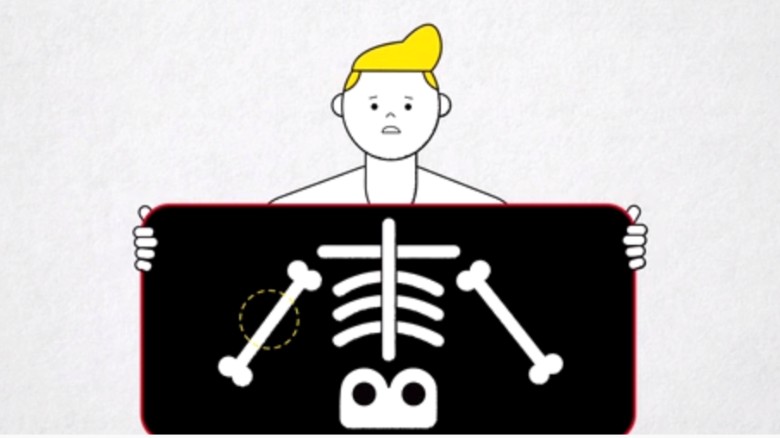

■ What if you could add collision coverage to your car after hitting that tree? Well, thanks to FoIB Holly R, we learn that health insurance startup Bind offers pretty much that for its self-insured corporate clients:

"Technology has made on-demand services a reality for everything from food deliveries to gym classes and car-sharing. What if you could have on-demand health coverage for big-ticket procedures like knee surgery?"

It does sound kind of 'too good to be true,' but it's apparently a legit service available to companies willing to take the leap. Bind in't actually an insurance company, but a third party administrator for some of UHC's self-funded groups.

Interesting.

■ Thanks to the folks at United Healthcare, we're privy to next year's new IRS limits for group and HSA-compliant plans:

"Technology has made on-demand services a reality for everything from food deliveries to gym classes and car-sharing. What if you could have on-demand health coverage for big-ticket procedures like knee surgery?"

It does sound kind of 'too good to be true,' but it's apparently a legit service available to companies willing to take the leap. Bind in't actually an insurance company, but a third party administrator for some of UHC's self-funded groups.

Interesting.

■ Thanks to the folks at United Healthcare, we're privy to next year's new IRS limits for group and HSA-compliant plans:

"Maximum out-of-pocket limit for 2019 group plans:

•$15,800 for family coverage ($14,700 in 2018)"

That's an increase of almost 10%, and of course the premiums will also be headed north, although we don't yet know by how much. There's a term for this: "unsustainable." And it makes alternatives like sharing ministries and Direct Primary Care (not to mention Short Term plans) more and more attractive.

On the other hand, maximum HSA contributions are increasing almost $50 a year for individuals. WooHoo!

from InsureBlog https://ift.tt/2tQpUeu

via